Multimedia content

- Images (1)

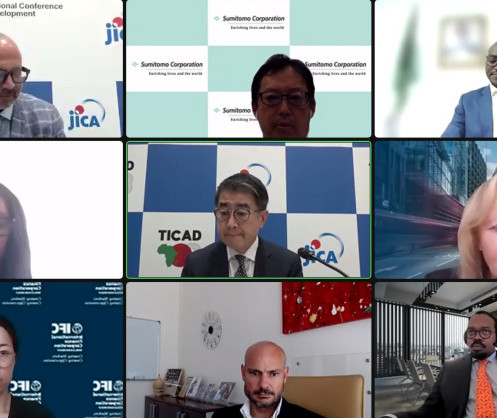

- 24 August TICAD-8 webinar on Private Sector Infrastructure Development Opportunities in Africa

- All (1)

Africa’s Record Private Investment in infrastructure in 2020 sends strong signal, African Development Bank Vice President (VP) tells Tokyo International Conference on African Development (TICAD) panel

The online event was held in the run-up to the eighth Tokyo International Conference on African Development, or TICAD, which takes place in Tunisia from 27-28 August 2022

This counter-cyclical role played by the private sector shows the importance of its growing role in infrastructure financing in Africa

Africa received its highest proportion of private sector investment in infrastructure in 2020, sending an important signal to governments and investors.

African Development Bank Vice President for the Private Sector, Infrastructure and Industrialization, Solomon Quaynor, underlined this point during a webinar organized by the African Development Bank and the Japan International Cooperation Agency (JICA) on 24 August. The online event was held in the run-up to the eighth Tokyo International Conference on African Development, or TICAD, which takes place in Tunisia from 27-28 August 2022.

Quaynor said the greater private sector investment came as most African governments contended with the Covid-19 pandemic, limited fiscal space and high debt-to-GDP ratios. “Private sector investment into Africa’s infrastructure rose to $19 billion in 2020, representing 23%, the highest since 2016. This counter-cyclical role played by the private sector shows the importance of its growing role in infrastructure financing in Africa,” he said in remarks at the close of the webinar, themed Private Sector Infrastructure Development Opportunities in Africa.

In opening remarks, Keichiro Nakazawa, Senior Vice President of the Japan International Cooperation Agency, said the discussion would focus on growth prospects for African countries and the role of the private sector in providing high-quality, sustainable infrastructure.

The panelists were Rami Ghandour (Metito), Tshepidi Moremong (Africa 50), Vuyo Hlompho Ntoi (African Infrastructure Investment Managers) and Yoshio Kushiya (Sumitomo Corporation). They were joined by representatives of leading development finance institutions – JICA’s Shohei Hara, Mike Salawou from the African Development Bank, and European Bank for Reconstruction and Development director, Sue Barrett.

The panelists shared perspectives, success stories and the challenges they faced to plug Africa’s estimated $67-107 billion annual infrastructure gap. Vivek Mittal, CEO of the Africa Infrastructure Development Association, moderated the discussion.

Mittal noted that four African countries – Kenya, South Africa, Ghana and Nigeria – accounted for the majority of private sector investment interest over the past two years. Mittal said digital activity in transportation and electricity received the highest interest. Urban sanitation – a key infrastructure building block – lagged.

“Projects take too long – 8-10 years – in Africa,” Mittal said, adding that slow development of local talent was another drawback.

According to Moremong, Africa 50’s robust pipeline in its priority sectors – energy, transportation, ports, bridges, ICT, health and education – is ample proof that the continent has bankable projects. The group’s experienced investment team works closely with development finance institutions and commercial banks, to ensure that their bankable projects continued.

She gave the example of Kigali Innovation City – a technology village that has broken the mould in terms of innovation. Rwanda, an agriculture-based economy, sees diversification of its sectors as critical.

“The success of this project is due to political will and capacity from both sponsors – Rwanda’s Development Board – and investors,” Moremong said. She said the parties had robust discussions on the allocation of risk, one of the major investment hurdles. Other general obstacles cited include limited deal pipelines, weak feasibility studies, technical studies and business plans, and delays in obtaining licenses.

The African Development Bank, the continent’s leading financier of infrastructure, has concluded a major public-private project in Kenya, the Nairobi-Nakuru-Mau road PPP, with an investment of $200 million. “We would like to partner with JICA to do more,” Salawou said, noting that the Bank was involved in a joint port in Morocco with the European Bank of Reconstruction and Development.

Shohei Hara said JICA’s long history working with governments would need to give way to a mind shift as they looked to greater participation in private sector-financed infrastructure. “Governments have to change their mindsets, as well as ourselves,” he said.

He also noted the role of multilateral partners such as the African Development Bank in mitigating risks such as foreign exchange, political, regulatory, policy and payment obligations.

During a recent trip to South Africa, Quaynor said he met with several key Japanese private sector companies with regional headquarters in Johannesburg, involved in multiple infrastructure sectors.

“Given the maturity of Japanese markets, these companies are strategically expanding globally but with clear risk-adjusted return expectations,” he said. “It’s good to see that our focus has been on solutions.”

Quaynor also highlighted the Africa Green Infrastructure Alliance, led by the African Development Bank, Africa50 and several global and African partners, including the African Union Commission and African Union Development Agency ( AUDA-NEPAD), Rockefeller Foundation, the European Investment Bank, the European Bank of Reconstruction and Development, Agence française de développement and the African Sovereign Investors Forum. The Alliance is seeking to develop green and smart infrastructure with scale and speed in energy, transport, water and sanitation, ICT, healthcare, and urban and rural infrastructure.

“We encourage JICA and JBIC to consider supporting this facility with concessional funds and grants. We also encourage Japanese private sector companies to contribute patient commercial capital to ensure that green infrastructure projects of scale are developed with speed in Africa,” Quaynor said.

Distributed by APO Group on behalf of African Development Bank Group (AfDB).

Contact: Amba Mpoke-Bigg, Communication and External Relations Department, email: media@afdb.org