Multimedia content

- Images (2)

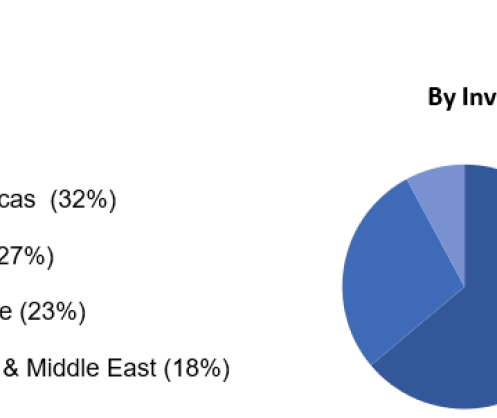

- Investor distribution statistics in English

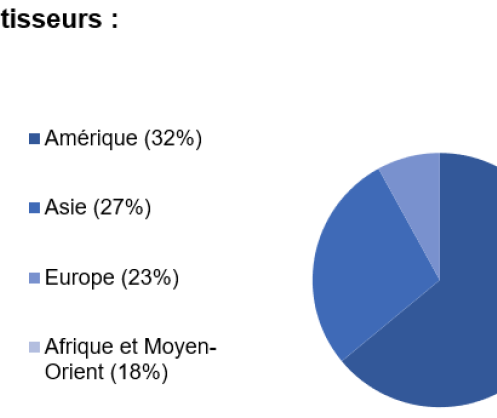

- Investor distribution statistics in French

- Links (1)

- All (3)

African Development Bank launches US$ 2 billion 1.625% Global Benchmark due 16 September 2022

Launched on September 11, the bond issue is the Bank’s second Global Benchmark of 2019, following a EUR 1 billion 10-year priced in March 2019

The African Development Bank achieved its tightest ever spread to US Treasuries, and we are grateful to our investors across the world for this outcome

The African Development Bank (www.AfDB.org), rated Aaa/AAA/AAA (Moody’s/S&P/Fitch, all stable), has launched and priced a US$ 2 billion 3-year Global Benchmark bond due 16 September 2022, its first US$ benchmark of the year.

Launched on September 11, the bond issue is the Bank’s second Global Benchmark of 2019, following a EUR 1 billion 10-year priced in March 2019. With this transaction, the Bank has now raised US$ 4.4 billion in 2019 to date and executed 61% of its borrowing program for the year. The transaction received strong support from investors globally, with order books reaching US$ 2.8 billion and 53 investors participating. The high quality of the order book is illustrated by the strong participation of Central Banks and Official Institutions, taking 64% of the allocations.

The African Development Bank decided to take advantage of favorable investor sentiment post summer break to access the 3-year tenor, in spite of volatile market conditions ahead of the Fed Meeting the following week. The mandate was announced on Tuesday, September 10, at 12:00 London time with Initial Pricing Thoughts of Mid-Swaps + 13 basis points (bps) area.

The transaction met strong interest from the outset, with Indications of Interest in excess of US$ 1.8 billion (excluding Joint-Lead Managers interest) when order books officially opened at 08:00 London time the following morning, with initial price guidance of Mid-Swaps + 13bps area.

Momentum continued throughout the European morning, with orders in excess of US$ 2.5 billion around 11:20 London time. At this time, final pricing was set at Mid-Swaps + 13bps. Following the close of the order book in the US, the size of the transaction was set at US$ 2 billion by 14:20 London time.

The transaction was priced at 16:24 London time with a re-offer yield of 1.679%, equivalent to a spread of 8.75bps vs UST 1.5% 15 September 2022, the issuer’s tightest print vs US Treasuries to date.

“We are delighted with this successful dollar Global Benchmark, and particularly pleased by both the very high quality of the order book and the solid participation of African Central Banks. The African Development Bank achieved its tightest ever spread to US Treasuries, and we are grateful to our investors across the world for this outcome, and the financing it will bring to the African continent”. Hassatou Diop N’Sele, Group Treasurer, African Development Bank

Transaction details:

|

Issuer: |

African Development Bank (“AfDB”) |

|

Issuer rating: |

Aaa/AAA/AAA (Moody’s/S&P/Fitch) |

|

Amount: |

US$ 2 billion |

|

Pricing date: |

11 September 2019 |

|

Settlement date: |

18 September 2019 |

|

Coupon: |

1.625%, Fixed, Semi-Annual 30/360 |

|

Maturity date: |

16 September 2022 |

|

Re-offer price: |

99.843% |

|

Re-offer yield: |

1.679% Semi-Annual |

|

Re-offer spread: |

Mid-Swaps + 13bps / UST 1.5% 15 September 2022 + 8.75bps |

|

Joint lead-managers |

Citi, Daiwa, HSBC, JP Morgan, Société Générale |

|

ISIN: |

US00828EEA38 |

Distributed by APO Group on behalf of African Development Bank Group (AfDB).

Media Contact:

Email: fundingdesk@afdb.org

About the African Development Bank Group:

The African Development Bank Group (AfDB) (www.AfDB.org) is Africa’s premier development finance institution. It comprises three distinct entities: the African Development Bank (AfDB), the African Development Fund (ADF) and the Nigeria Trust Fund (NTF). On the ground in 41 African countries with an external office in Japan, the AfDB contributes to the economic development and the social progress of its 54 regional member states.

For more information: www.AfDB.org